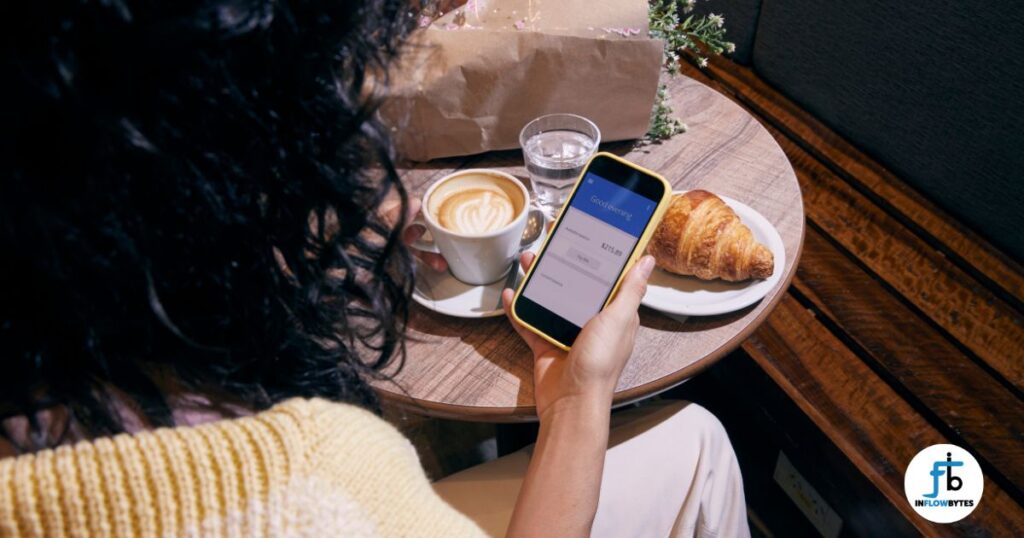

Managing money is important, and many people now use their smartphones to help with budgeting. Budgeting apps have become popular tools for tracking spending, saving money, and setting financial goals. However, like any tool, they have both good and bad sides. This article will explain the main advantages and disadvantages of budgeting apps to help you decide if they are right for you.

What Are Budgeting Apps?

Budgeting apps are programs that help you manage your money. They connect to your bank accounts and credit cards to show all your finances, your income, expenses, and savings, in one place for better money management. Some people prefer these apps instead of traditional methods like writing a budget on paper or using a spreadsheet.

Advantages and Disadvantages of Budgeting Apps

Below is a table summarizing the pros and cons of using budgeting apps:

| Advantages | Disadvantages |

| Easy to Use: Check finances anytime, anywhere with automatic tracking. | Privacy and Security Risks: Apps may share data with third parties or face security breaches. |

| Automatic Expense Tracking: Transactions are recorded and categorized without manual effort. | Hard to Learn: Some apps are complex and require time to set up and understand. |

| Better Financial Awareness: Helps users track spending habits and get spending alerts. | Some Apps Cost Money: Many budgeting apps charge a subscription fee. |

| Helps Set and Reach Financial Goals: Allows users to set savings goals and track progress. | Too Much Dependence on Technology: If the app crashes, you may lose access to your budget. |

| Customizable Budgets: Users can create custom categories and adjust budgets as needed. | Bank Syncing Issues: Not all banks sync properly, leading to incorrect data. |

| Extra Learning Resources: Many apps provide financial education, tips, and forums. | Hard to Track Cash Spending: Manual entry is needed for cash purchases, which can be inconvenient. |

| Security Features: Encryption and authentication protect financial information. | Might Lead to Less Money Awareness: Relying too much on automation can reduce financial engagement. |

Alternatives to Budgeting Apps

If budgeting apps don’t work for you, here are other ways to manage your money:

1. Spreadsheets

- Use Excel or Google Sheets to track spending.

- Offers complete control over how you budget.

- No subscription fees.

- No need to share financial data with third parties.

2. Pen and Paper

- Simple and easy for those who prefer writing things down.

- No technology needed.

- Good for visual learners.

- Provides a physical record of your spending.

3. Cash Envelope System

- Use actual cash for different budget categories.

- Put cash in separate envelopes for expenses like groceries, rent, and entertainment.

- When an envelope is empty, you stop spending in that category.

- A clear way to control spending without using technology.

Is a Budgeting App Right for You?

To decide if a budgeting app is a good choice, think about:

- Are you comfortable using technology?

- Do you prefer convenience over manual tracking?

- Are you okay with sharing financial data with an app?

- Are you willing to pay for premium features?

- What budgeting method works best for your lifestyle?

The best budgeting method is the one you will actually use consistently.

Conclusion

Budgeting apps can be helpful because they make money management easy, track spending automatically, and provide useful insights. However, they also have drawbacks like privacy concerns, costs, and a learning curve.

Before choosing a budgeting app, take time to research different options. Read reviews, compare features, and check if there are any costs. Think about what matters most to you when managing your money.

Remember, the goal of any budgeting method is to help you take control of your money. Whether you use an app, a spreadsheet, or just pen and paper, the most important thing is finding a method that works for you and sticking with it!